First, I apologize if the title is confusing or if there is a better wording. I am unfamiliar with many finance terms, so there may be something accurately describes my problem.

I am trying to calculate how to disburse equally over a period of time. Ordinarily, this would be easy. If I had $100,000 to disburse over 10 years, it would work out to disbursements of $10,000/yr.

Unfortunately, I am also trying to factor in the growth of the balance. For example, if I wanted to disburse that same $100,000 over two years and it grew at 6% APY (see some assumptions below), then I would disburse $51,456.31 each year. After the first year, the balance would be $48,543.69, which would then grow to $51,456.31 after the 6% APY. This makes for equal disbursements of an appreciating asset over two years.

ASSUMPTIONS: I am assuming that the disbursement is made lump-sum at the beginning of the year. In the previous example, this means $51,456.31 is removed on January 1st and does not appreciate in value.

Unfortunately, there is no good LaTeX input for math here, but my formula for the two-year scenario is:

w = (1 + r) * (b - w)

where 'w' is the yearly withdrawal amount, 'r' is the APY, and 'b' is the initial balance. The two-year scenario is easy because the withdrawal in the second year (the entire remaining balance with growth) must equal the initial withdrawal amount.

When I try to extend this to a three-year scenario, I get

3 * w = b + r * (b - w) + r * (r * (b - w) - w)

3 * w = b + r * (b - w) + r^2 * (b - w) - r * w

3 * w = b + r * b - r * w + r^2 * b - r^2 - w - r * w

3 * w = b + b * (r + r^2) - w * (2 * r + r^2)

3 * w + w * (2 * r + r^2) = b + b * (r + r^2)

w * (3 + 2 * r + r^2) = b + b * (r + r^2)

w = (b + b * (r + r^2)) / (3 + 2 * r + r^2)

Unfortunately, this seems to be wrong since given the same values as above, it produces a result of $34,050.45, but evaluating manually shows the correct value to be $35,293.38.

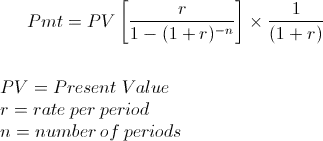

Even extending that formula would be difficult after the three-year simulation. Is there a better way to do this?