I'm trying to create a helper in a contract that lets the user deposit a single token and have it internally swap to the other token and add it as liquidity.

Lets say there is an LP with ETH and BTC and a user supplies only ETH, then how much of that ETH should be swapped to BTC to maximize the liquidity returned?

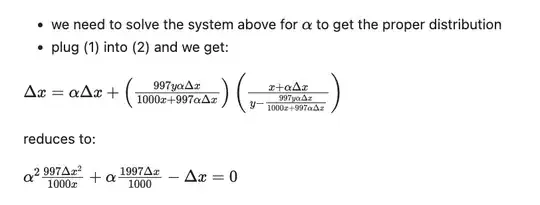

You could swap 50% percent but I'm looking for the exact answer that takes into account the 0.3% fee and the change in ratio because of the swap.

Zapper calculates as follows:

function calculateSwapInAmount(uint256 reserveIn, uint256 userIn)

internal

pure

returns (uint256)

{

return

Babylonian

.sqrt(

reserveIn.mul(userIn.mul(3988000) + reserveIn.mul(3988009))

)

.sub(reserveIn.mul(1997)) / 1994;

}

Zapper uniswap add contract (https://etherscan.io/address/0x5ACedBA6C402e2682D312a7b4982eda0Ccf2d2E3#code)

How is this formula derived and is it correct?