I'm preparing for CFA L1. I assumed that 3 year spot rate of treasury to be equal to the YTM of 3 year treasury bond. The Schweser notes define spot rate as below

Yields on zero-coupon government bonds are spot rates.

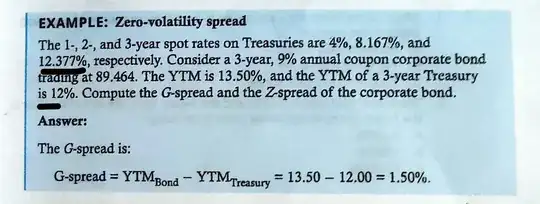

However in the below example from the Schweser notes, there's difference between 3 year spot rate and YTM of 3 year treasury bond. I'm trying to understand why. Thanks in advance