Why are cost functions typically assumed to be convex in producer theory of (introductory) microeconomics?

For me this goes against the intuition of economies of scale. There are fixed costs (FC) which contribute to concavity of the cost function. There are also variable costs (VC) which may be concave, linear or convex. If we are on the concave part of VC, total costs (TC) must also be concave due to both FC and VC being concave. If we are in the linear part of VC, TC are again concave due to the concavity of FC. And if we are in the convex part of VC, TC may be either concave, linear or convex depending on the relative influence/weight of FC and VC on/in TC. However, even in the case where TC is convex, the producer does not have to operate that way. It can rather operate multiple copies of its production facility each at the level where TC is concave or linear to ensure the TC added over all production facilities is never convex.*,** This makes the assumption of convex costs suspect for me.

I do see one reason why convexity could occur, though. It is if resources are becoming scarce and the producer is big enough to influence the prices in the input markets. However, the producers are assumed to be small in perfect competition, yet their cost functions are assumed to be convex. This appears contradictory to me. So what am I failing to see?

*The fact that FC are incurred with each copy of the production facility might or might not make this a poor strategy depending on the relative weight of FC and VC.

**I think I borrowed the idea for this argument from Varian "Microeconomic Analysis". In 3rd edition, Section 5.2 "The geometry of costs" p. 68 it says:

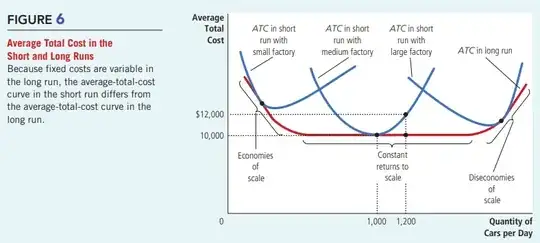

In the long run all costs are variable costs; in such circumstances increasing average costs seems unreasonable since a firm could always replicate its production process. Hence, the reasonable long-run possibilities should be either constant or decreasing average costs.

The cost function is also shown to be concave in the subsequent section 5.4 "Factor prices and cost functions".

Edit: Thank you for all the great answers! It seems we can have different plausible stories with opposite implications. So far it seems one can plausibly argue for both convex and concave costs. The crux of the matter becomes the assumptions needed to make one story more plausible than the other. Thus the question is, what are the assumptions taken to make convex costs plausible (and concave costs implausible) in introductory microeconomics?