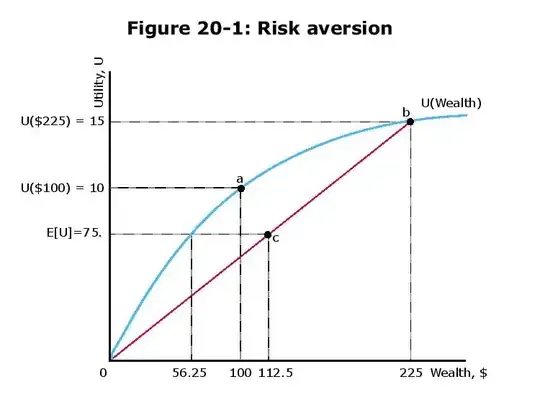

There is a typo in the figure that introduces some confusion in the previous answer, which is basically wrong.

Based on the numbers and the figure, the utility is such that $$u=\sqrt{x},$$ so

$$E[u]=\frac{1}{2} u(100+125) + \frac{1}{2} u(100−100)= \frac{1}{2} u(225) =\frac{1}{2} \sqrt{225} = 7.5$$.

By definition, the risk premium (R) must satisfy the following condition:

$$ E(u) = u(100 - R)$$

$$ \Leftrightarrow 7.5 = \sqrt{100 - R}$$

$$ \Leftrightarrow (7.5)^2 = 100 - R$$

$$ \boxed{\Leftrightarrow R = 43.75}.$$

Notice that this bet is better than a "fair game" because the expected gain is not zero, but positive (0.5∗125+0.5∗(−100)=12.50.5∗125+0.5∗(−100)=12.5). So, despite this very good bet, the risk-averse agent characterized by her concave utility function ($u = \sqrt{x}$), is ready to pay almost half of her initial wealth to avoid risk and get the certainty equivalent amount.