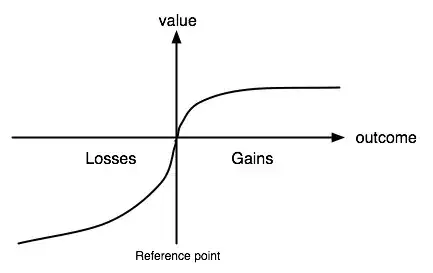

This is Kahneman's value-plot on prospect theory:

QUESTION: Why is the Marginal Utility of losses deminishing?

CONTEXT:

I fully understand that the Marginal Utility of gains deminishes: 100 dollar gains has less utility to me when I am rich than when I am poor.

But to me it is different with losses: If I can choose to lose 100 dollars for sure or a 50% chance to lose 200 dollars I would definitely not go for the bet! Why would I risk losing even more? After all, like most people, I am risk-averse. My reference point would be that I already lost 100 euro's.

Furthermore: If all I own should be 200 dollars, I might regret losing 100 dollars very much, but I will regret losing a second 100 dollars even more because then I would be left with nothing and I can't buy any food.

In other words: I guess my reference point is always zero and compared to that I will always be risk-averse... but isn't that what most people do or should do?

UPDATE: This article shows that the Value-curve can also be shaped differently, for example under time pressure: https://www.sciencedirect.com/science/article/pii/S0749597815000722