Consider a pure exchange economy with two goods ($x_1,x_2$) and two consumers $A,B$. Both users have an initial endowment, $(\omega_1^A,\omega_2^A)$ and $(\omega_1^B,\omega_2^B)$ respectively. A price ratio $p^*$ is an equilibrium price ratio if after both users maximize their utility given their budget, that is $\forall i\in \left\{A,B\right\}$ they solve the problem \begin{align*} \max_{x_1^i,x_2^i} \ & U(x_1^i,x_2^i) \\ \\ \mbox{s.t. } & p \omega_1^i + \omega_2^i = p x_1^i + x_2^i, \end{align*} the maximizing bundles $(x_1^A,x_2^A),(x_1^B,x_2^B)$ are such that the markets are in equilibrium, meaning \begin{align*} x_1^A + x_1^B & = \omega_1^A + \omega_1^B \\ \\ x_2^A + x_2^B & = \omega_2^A + \omega_2^B. \end{align*}

Suppose that $U$ fulfils the usual conditions of convexity, monotonicity (or local non-satiation, pick whichever you like) and continuity. Given an initial endowment is it possible to have two different equilibrium price ratios? The ideal answer would give a simple example, but non-constructive proofs are also okay. I am especially interested in examples where both equilibria are interior points of the Edgeworth-box.

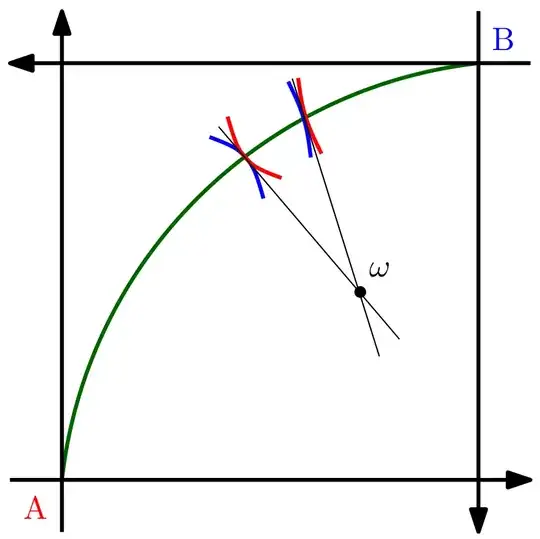

A graphical representation of the problem:

Green is the set of Pareto-optimal points, red and blue are indifference curves, thin lines are budget lines.

Green is the set of Pareto-optimal points, red and blue are indifference curves, thin lines are budget lines.