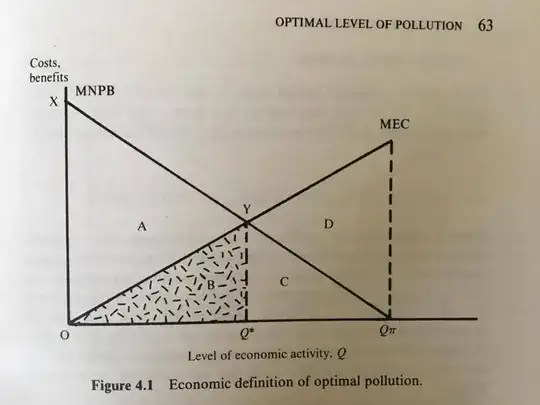

I'm reading the book "Economics of natural ressources and the environment" written by D. Pearce and R. Turner. They explain that the competitive equilibrium is not a Pareto optimum in case of (positive or negative) externalities. The example they use is a firm that has an activity Q and this activity creates some pollution. They illustrate it in figure 4.1 (figure below). MNPB stands for "marginal net private benefits" and MEC "marginal external cost". MEC is thus the extra damage done by pollution arising from the activity measured by Q.

The firm will try to maximize its benefit, i.e. reach an activity of Q$^\pi$. Q$^*$ is the level of activity to have a social optimum. I understand the reasoning so far.

What I do not understand is why Q$^\pi$ is not Pareto optimum. If we had to reach Q$^*$ from Q$^\pi$, the firm would loose some of its utility so Q$^\pi$ should be Pareto optimal.

I feel like I do not understand the exact meaning behind the notion of the Pareto optimality.

Source of image: "Economics of natural ressources and the environment", D. Pearce and R. Turner, Harvester, New York, 1990.