Your intuition is entirely correct. Inflation is calculated based on a "standard basket", whereas real baskets vary among different consumers. As such, the incidence of changes in prices affect consumers differently.

A good treatment of the issue is this piece by the IFS, UK. Basically, distributional effects of inflation would not exists if:

- households buy the same

- price of all items change equally

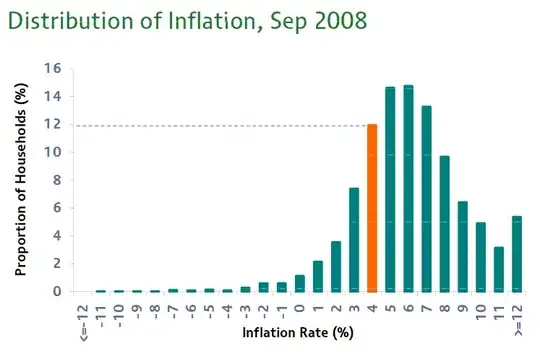

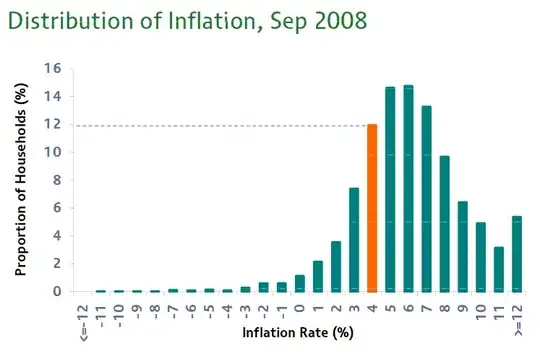

As you can imagine, both are not true. The report calculates then the rate of inflation faced by different households, taking Sept of 2008 as example, leading to the following result:

This is, inflation can be very different across households. Check the document for more details and insights.

Finally, an example of a theoretical treatment (aka model) is here. The authors model a monetary economy where the cost of credit is a non-linear function of income, such that the rich have a lower cost per unit of credit. This means that rich buy their consumption with a greater proportion of credit than cash, compared with the poor. Then, as inflation is basically a tax on cash, this means the same inflation affects the rich and poor differently. In fact, inflation is regressive. This is a well-known fact in political discussions (e.g. here).