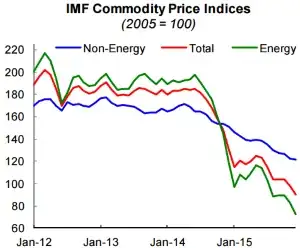

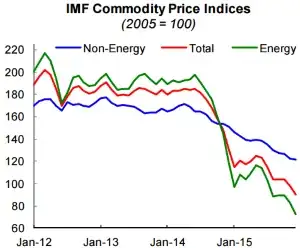

First of all, the fall in prices does not only concern oil but most commodities — in particular raw materials such as iron ore, copper, nickel and many other — though it is indeed most noticeable for gas and oil. To see the full extent of this drop in price, check out the IMF Primary Commodity Prices and their monthly reports, from which I extracted the following chart:

What are the causes of lower commodity prices?

There is no secret: the demand is falling and the supply increasing. The demand is falling mainly because of the slowing growth in China. As China imports less commodities to fuel its industry, a large chunk of the demand for commodities has disappeared, leading to lower prices. But simultaneously, the supply keeps steady or increasing on most of the commodity markets. On the oil market for example, 2015 has been a great year of surge or expected surge: OPEC countries are committed to keep flooding the market — mainly because the Gulf countries can afford lower prices thanks to low production costs, while their competitor might not sustain low prices very long. Furthermore, the ban on Iranian exports and the ban on US exports are going to be lifted. The market anticipates already this formidable future new supply, which drives prices down. The US are quasi independent as far as Oil is concerned, as the Shale gas industry has been rising in this country.

What are the consequences of lower commodity prices?

The first consequence is not caused by lower commodity prices, but rather by the root of this price drop: China's growth is slowing. Therefore there is more uncertainty than before about this market. As a consequence, exporters to China begin to worry as well as firms who have factories in China, as slowing growth and reduced imports might be the sign of a stabilization and potential lower inner demand. China being one of the world's biggest market, and one with a still relatively low penetration for technologies, it is indeed worrying. Thus, the stock of a lot of companies have been going down all over the world because of the situation in China, reflected in Oil prices.

Another crucial factor comes into action: most firms in the commodity sector have huge debt. Indeed, this sector requires big investments to begin the exploitation. Among others, Glencore's $30bn debt has been discussed a lot, but it is only an example among many others. In particular, there are two areas that are under threat: shale gas and renewable. These two sectors require higher investment than others. For shale gas, because the exploitation is costly and technically complex. For the renewable, because the R&D is costly and the production as a whole is costly as it uses high technologies. Lately, the partial default of Abengoa gave us a taste of what might follow. The debt accumulated by this industry is by no mean sustainable with such low commodity prices.